Protect Your Business Income

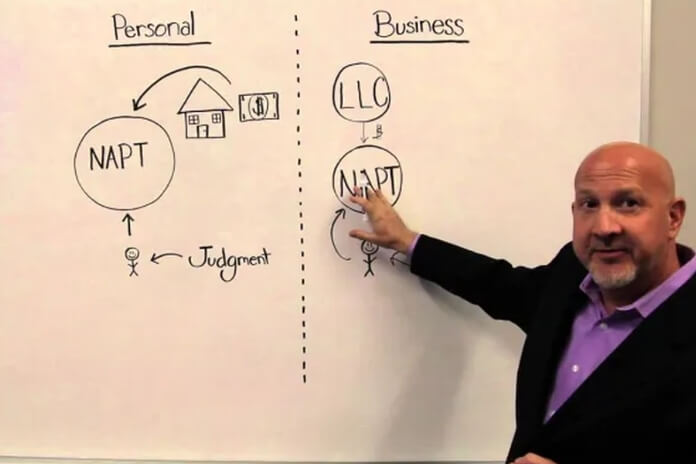

A Nevada Business Holdings Trust is a Nevada Asset Protection Trust that is designed by RDJ LAW to hold the interest in your business, to shield and protect your income flow from the business.

All too often, business owners do not think about protecting the income from their business in the event that they get sued at some point. But what happens when a business owner gets sued outside of the business front and ends up with a judgment against him/her personally? The classic example is a car accident. Imagine that you are driving one day and you get into an accident. The other party is seriously injured, sues and ends up getting a judgment against you in an amount that far exceeds your car insurance policy limits. In such a case, your auto insurance carrier will payout the policy limit (probably $25,000) to the injured party and then the insurance company is out of the picture. Now the plaintiff with a judgment can go after you personally to recover the balance of their judgment (which could very well be a multi-million dollar judgment) from your personal assets. From the time that the court enters the judgment against you, the judgment creditor may then begin to take action to collect its judgment against you by force of law. They can garnish personal bank accounts and your wages, they can seize any personal assets that you own that are not specifically exempt under the law and they can foreclose against any real estate properties that are not covered by the homestead exemption.

RECOVERING AGAINST YOUR BUSINESS INTERESTS

With regard to any businesses that you own an interest in, there is potential risk to both the business ownership interest itself and to the income flow from that business. The different types of business entities and a full discussion of what protection there may be is a lengthy discussion for another time. But briefly, for our purposes here, an LLC membership interest is generally protected from outright seizure of the membership interest by a judgment creditor through what is commonly called “charging order protection”). But an LLC membership interest in some states may have various levels of limited protection or, effectively, none at all (for example, the Hawaii LLC statue specifically allows a judgment creditor to foreclose the “lien” that a charging order against an LLC member’s membership interest creates – which means the LLC member really has no protection in Hawaii). The Nevada LLC law specifically limits a judgment creditor’s remedy against a Nevada LLC member’s membership interest to the charging order (a charging order is an order from the court in favor of the judgment creditor to the company to deliver any profit distribution or payment that is being made by the company to the judgment debtor to the judgment creditor, instead. But, under the Nevada LLC law, the charging order only enables the judgment creditor to sit an wait and hope for a profit distribution from the LLC to the member whose membership interest they have charged (effectively they have a lien against the membership interest). Under the Nevada law, they cannot force a distribution of profit and they explicitly are not allowed to try to wiggle any other remedy out of the charging order or otherwise against the LLC membership interest. That’s the good news. The bad news is that, as long as there is a judgment and a charging order against your NV LLC membership interest, you are tied up and unable to get the money out of the LLC where you need it to pay your bills and to live on. (CLICK HERE FOR VIDEO ON THIS TOPIC)

A Nevada Corporation has the same “charging order” exclusive remedy protection as an LLC or partnership does, if the corporation is not publicly traded, is not a professional corporation and has 100 or fewer shareholders (NRS 78.746). However, this protection of your stock in a corporation only applies to a Nevada corporation. If you own stock in a corporation domesticated another state, you likely don’t have any charging order or other protection at all for your stock ownership interests. This means that the judgment creditor may seize your stock in the company and they will then own the stock in your company – a very bad outcome for you and your business.

SETTING UP A NEVADA BUSINESS HOLDINGS TRUST TO OWN YOUR INTEREST IN THE BUSINESS

If you had set up a Nevada Business Holdings Trust through RDJ LAW prior to that car accident happening, your interest in the business and your income flow from it would be safe and you would have the full benefit of the profits from your business. When a Nevada Business Holdings Trust owns the interest in the company, whether it is an LLC, a partnership or a corporation, the profits from that company may be distributed into the Trust that owns your interest in the company. If the judgment creditor cannot prove by clear and convincing evidence that there was a transfer of money or assets “from you” to the Nevada Business Holdings Trust that was fraudulent as to the judgment creditor specifically, they cannot reach into the trust to recover anything to satisfy their judgment against you personally.

Profits from the business can be held in the Trust for as long as you want. If you have a judgment against you personally, the Trustees may pay your bills for you directly from the Trust being sent directly to where it needs to be paid. So, you truly have full benefit of the income from the Trust and can continue to have all of your financial needs met from the profits of your company, even though there may be a personal judgment against you and the judgment creditor cannot seize either the money in the Trust or the ownership interest in the business.

ADDITIONAL BENEFITS OF THE NEVADA BUSINESS HOLDINGS TRUST

In addition to protecting your ownership interest in the business and protecting your income flow from the business, the Nevada Business Holdings Trust will also provide for avoidance of a probate of the business interest following your death, as the business ownership interest will pass to the beneficiaries that you’ve specified in the Trust following your death, without any court involvement.

The Nevada Business Holdings Trust can also provide some anonymity of your interest in the business as well, which can also be a plus.

The Nevada Business Holdings Trust is generally established as a “grantor trust” for federal taxation purposes which means that it is a “flow-through” tax entity and will not complicate your tax filings and situation.

If you have multiple businesses, the Nevada Business Holdings Trust can hold your ownership interests in all of the businesses or they can each be “compartmentalized” for maximum exposure minimization by establishing a separate Nevada Business Holdings Trust for each business.

Don’t get caught with your pants down and your business interests exposed. Contact RDJ LAW today to schedule a free consultation and evaluation of your protection and planning needs.