Significant Changes to the Nevada Homestead Law that are Effective in 2022

Due to changes made to Chapter 115 of the Nevada Revised Statutes (NRS) by the Nevada Legislature in 2019, the Homestead Exemption amount that a Nevada homeowner can claim has been increased from $550,000 to $605,000 in equity value. This is an increase of $55,000 in the equity value of the primary residence that will be exempt in Nevada from the claims of a judgment creditor, as long as the Homestead Declaration has been properly recorded to claim the entitled exemption.

The increase in the exemption amount is the good news. The bad news for homeowners is that NRS 115.055 has been added to the Homestead statute. NRS 115.055 limits the protection of the Homestead exempt proceeds from the sale of the home. Specifically, NRS 115.055 states that the $605,000 exempt amount from the proceeds of a sale of the home are only protected if the proceeds are reinvested in another property of like kind for which a Homestead will be made and (1) the new property to be purchased is identified not later than 45 days after the sale of the Homestead property; and (2) you take possession of the new Homestead property not later than 180 days from the sale of the original Homestead.

What this (NRS 115.055) effectively means, is that, if you sell Homestead property in Nevada while there is an outstanding judgment creditor, the proceeds from the sale of your homesteaded home will only be protected for a maximum of 180 days from the date of sale – and only if the proceeds are reinvested in new Homestead qualified property on which a Homestead Declaration is recorded.

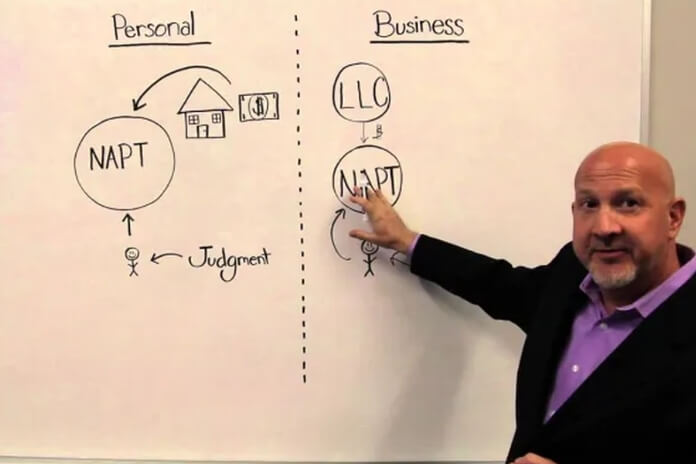

In sum, the Homestead law update is bittersweet news for Nevadans. This change underscores the importance of putting your Nevada home into a Nevada Asset Protection Trust, in order to protect the proceeds from the sale of your home beyond the limited time and manner restrictions that are now imposed by the new addition to the Nevada Homestead law.